Availability: In Stock/Ready to Ship.

Suggested retail price shown above.

For discounted Bookstore or School District bulk orders: Contact Us

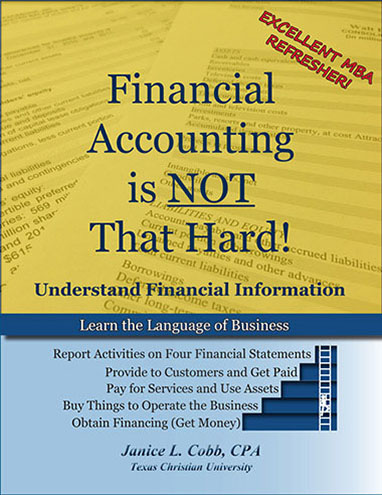

This book will teach you about the language of accounting and finance and how accountants determine reported values. You will be able to read and understand the four financial statements like a professional. Accounting is not math. Accountants add, subtract, multiply and divide using a calculator. Accounting is how companies explain their financial position and the results of operating the business to those outside the company. Students use a general ledger, a cost sheet they prepare, and inventory reports as source data. They learn which data must be used for different analyses, determine which decision the analysis supports, and assist the owner with making good business decisions.

This book makes it easy to understand accounting by using a step by step approach to explain the following:

• The language of business.

• The purpose of each financial statement.

• How the most common types of business transactions are reported on the financial statements.

• How common business transactions change each financial statement.

• Estimates and other issues that affect reported financial information.

• Financial statement analysis used to make investment decisions.

• Overview of Financial Statements

• The Balance Sheet

• Things That Change the Balance Sheet

• The Income Statement

• More on the Income Statement

• Revenues and Expenses Change the Balance Sheet

• The Statement of Stockholders' Equity

• The Cash Flow Statement

• Footnotes and Other Information

• Financial Statement Analysis

• Accounting Estimates and Other Things to Consider

• Appendix A: Gathering Data and Preparing the Financial Statements